When should your Startup Break-even?

- Ritwik Khator

- Nov 3, 2025

- 4 min read

Updated: Jan 14

Here’s the deal: On one side, we have the younger generation championing startups that disrupt industries and make it large. And on the other side, we have veterans glaring with shock at the massive amounts of cash these startups burn in pursuit of growth, coupled with the lofty valuations they command.

This leaves many founders wondering, when should startups aim to break even? is it standard practice for them to burn cash during their early stages, or should they strive for profitability from day one?

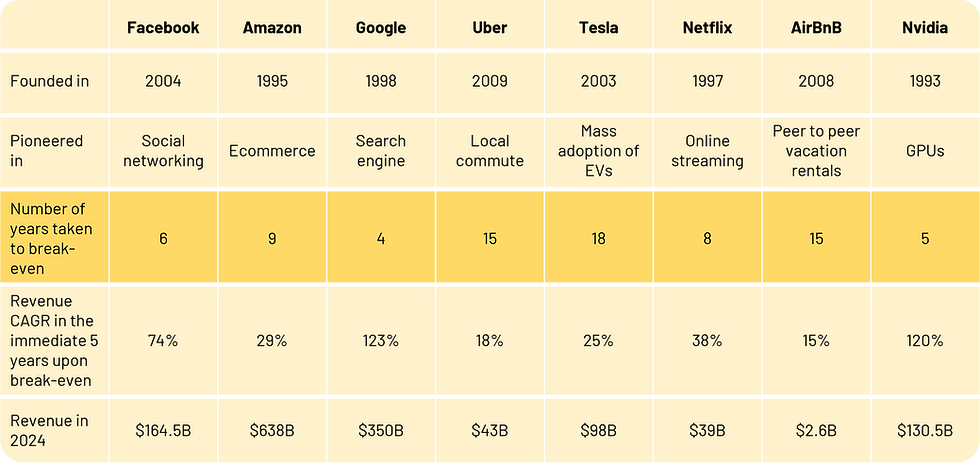

The best way to answer this is to draw lessons from some of today’s biggest Western tech giants who were once fledgling startups fueled by disruptive business models and the audacity to dream big. Refer table below:

Here’s what we learn from it:

Each of these tech giants has been a pioneer in their space. Their transformation from fledgling, VC-backed startups to industry behemoths underscores a key truth: disrupting industries, reshaping perspectives, and influencing consumer behaviour all come at a cost. The most successful among them took anywhere between 4 and 18 years to break even.

That said, the data above also debunks a common myth among founders that achieving profitability means compromising on growth. In fact, every one of these companies experienced rapid expansion in the five years following break-even. Which means the pursuit of profitability isn’t about slowing down but about finding the right market, pricing strategy, and cost structure for your product.

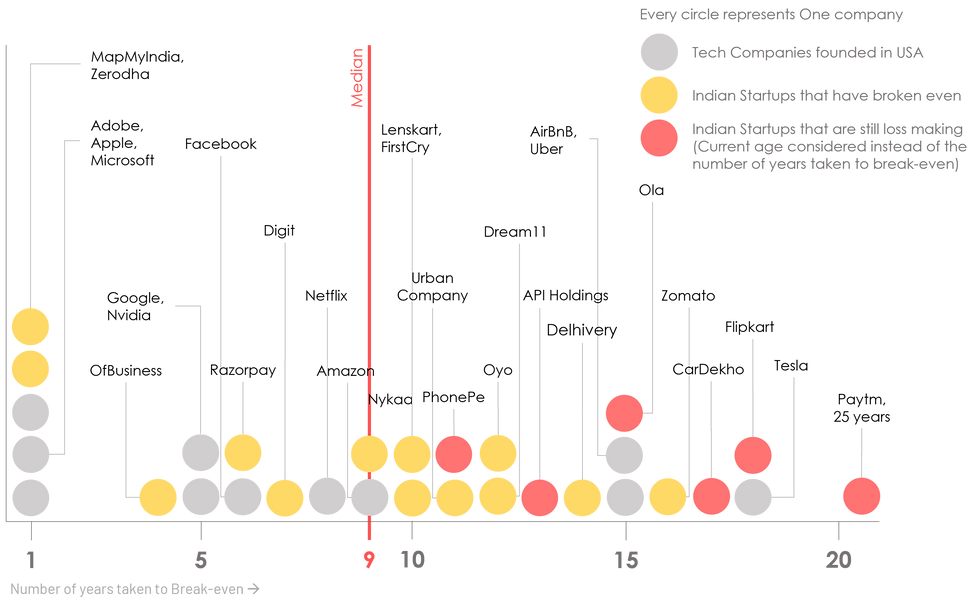

Now let's look at where the Indian Startups stand:

For comparison, we analyzed the profitability status of 19 startups of India’s Unicorn club, arriving at a median of 9 years to break even. We plotted the number of years these companies took to break even, alongside the West’s behemoths. Here's where we stand:

So what do we learn from this?

9 years

Within our sample set of 28 companies (22 profitable), the median break even point stands at 9 years. However, if you’re adopting this as a benchmark, remember: companies like Zerodha and Microsoft turned profitable in their first year, while others like Tesla and Uber took much longer. At its core, it’s crucial to recognize that businesses exist to generate dividends for their shareholders. Therefore, it's best to set an upper threshold of 5 to 10 years as a sensible benchmark for breaking even in your business.

E-commerce companies like Nykaa, Lenskart and FirstCry are right in the middle of the chart along with their western counterpart Amazon, having taken 9-10 years to break even - a healthy sign. Makes us wonder, what's wrong with Flipkart then (18 years and counting)? On the other hand, Ofbusiness - which is working in the B2B E-Commerce space has outperformed all its peers, taking only 4 years to break even.

PhonePe, Ola, CarDekho, API Holdings and Paytm- all are running out of time to break even. While all have made efforts to minimise losses with y-o-y negative margins improving, apart from PhonePe, all have struggled to maintain their scale of operations (in fact also witnessed contraction of sales) while cutting down on expenses.

Interestingly, 1/3rd of the Indian Unicorn Club (totalling to 44 companies) remains loss making even after crossing the 9 year break even benchmark. This suggests that India's ecosystem is coming of age and also explains why there's so much focus on profitability by VCs off late.

But before you write off the laggards, understand this:

Many startups choose to stay unprofitable longer- because they can afford to. Backed by investors and flush with cash, they often prioritize market dominance over immediate profits. By keeping their prices competitive and user acquisition aggressive, they buy time to outlast competitors and continue to mold consumer habits. In truth, a lot of these companies can flip the switch to profitability whenever they decide to.

The proof? Look at Indian tech firms in the run-up to their IPOs. You'll notice something intriguing: In 12 to 24 months before listing, they suddenly turn profitable. Lenskart, Mama Earth, Urban Company and Oyo - all have the same pattern. Actually, it’s rarely accounting wizardry; it’s a deliberate pivot. They tighten performance marketing, trim fat on hiring, and shift from hyper-growth to sustainable growth mode - all in pursuit of a cleaner story for public markets.

To sum it up:

If you’re building in sustaining innovation, you’re expected to be operationally profitable from early on - ideally before your first institutional round. Yes, you might burn cash between Seed and Series B as your revenue curve lags expenses by a few months, but profitability should be visible on the horizon.

However, if you’re building in disruptive innovation, the game is different. Set your target on breaking even within 5 to 10 years. In these cases, early losses aren’t seen as red flags but as investments into consumer education, R&D, and habit formation.

Startup Indian can support startup founders and ventures in the following ways:

Fundraise Preparation - Pitch Deck, Financial Model, Business Valuation, When-How Much-Whom to Raise From, and more. Know more here.

Investment Banking (Fundraise support) - Leverage our network to reach out to investors, lead conversations on your behalf, deal negotiation and closure. Know more here.

Transaction Advisory - Draft, review or vet SHA, SSA or SSHA for any funding round. Draft founder's agreement, advisory agreement, ESOP policy, share-based payment agreements, and more. Know more here.

Shared CFO - Finance function handholding, top-notch governance, internal controls, ongoing financial planning and more. Know more here.

This article featured in our Founder's Playbook which answers questions around startup fundraising - when, how much, at what price, and more. You can access the Playbook here.

Comments