What went wrong with Byju's? - Deep Dive

- Ritwik Khator

- Jan 26, 2024

- 9 min read

Updated: Feb 16, 2024

Despite the present predicament at Byju's, one thing remains constant, i.e. Byju Raveendran (Co-founder and Group CEO) continues to teach thousands. Just that his subject matter has changed- a decade ago, he would fill up stadiums teaching Math, to now, teaching some of the toughest lessons of business to budding entrepreneurs with the rise and fall of his own startup, Byju's.

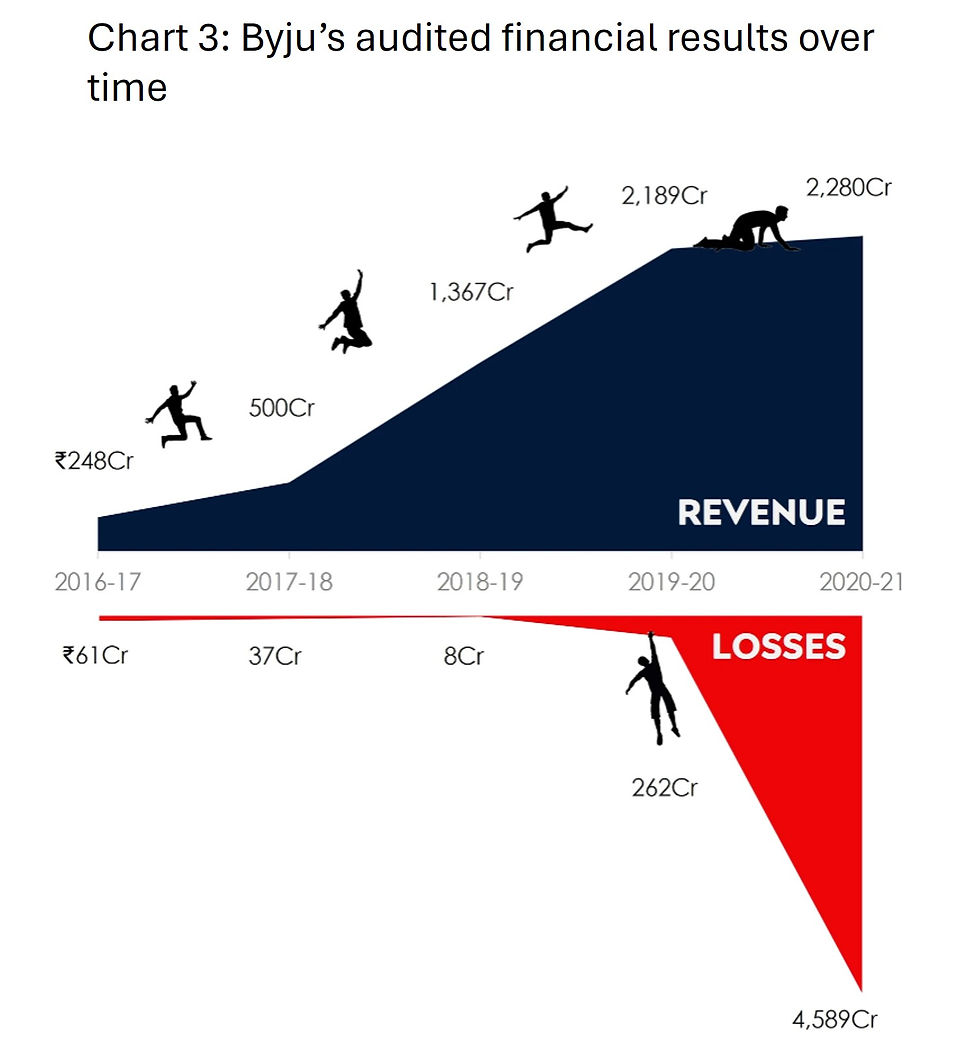

Here's the Edtech Unicorn's wild journey of the last 4 years depicted in a chart:

The Highs: In Mar'22 Byju's became the most valuable startup of India and the most valuable Ed-tech startup globally, with a pre-money valuation of $21Bn (Growing almost 3 times in just 2 years). Around the same time, the company also recorded having close to 60,000 employees globally. Byju's has raised a little over $5Billion till date and has acquired 19 companies, having spent over $3.5Bn to acquire.

The Lows: Investors like Prosus and BlackRock have marked down the valuation of Byju's in their books to as low as $1Bn in Jan'24. The total employee count has come down to around 17,000. The company’s overseas lenders have filed an insolvency petition against it while the company is actively looking to sell some of its biggest acquisitions in a desperate attempt to raise funds.

Wondering what happened in just a span of 18 months?

Well, we did our research and narrowed it down to 5 cascading problems:

When the Capital was abundantly available, Byju's decided to acquire other businesses instead of investing in its core operations that was still struggling to show clear signs of profitability.

The founders continued to show an optimistic picture of the company's financial performance when the audited financials read an opposite story.

Byju's was anticipating more capital in the near future, which never came.

Byju's thought Debt is cheap.

Unhappy customers and leaders’ exodus.

Let's dive deep:

Problem 1:

When the Capital was abundantly available, Byju's decided to acquire other businesses instead of investing in its core operations that was still struggling to show clear signs of profitability

Phase 1 began with the onset of Covid, causing the world's biggest Venture Capitalists to flock to India to get their hands on the ballooning Edtech Sector of India. At this juncture, Byju's that was already valued at $8Bn got the most favorable investor attention. However, instead of raising capital to scale up its own operations, it decided that the time was right to grow inorganically.

As Byju Raveendran would put it back then, "sooner or later everyone in Edtech will directly or indirectly work for the company."

Through Phase 1, Byju's raised close to $3.8Bn from various Funds and another $1.2Bn in Debt. During the same time, the company acquired as many as 11 Companies dishing out over $3.1Bn in the process (approx. 80% was paid in cash and the rest in Byju's shares). Here's the list of some of its biggest acquisitions:

As the founders explained it, the idea behind actively acquiring other EdTech peers was to gain access to each touchpoint of a fellow learner's learning journey, such that they could create an all-encompassing learning solution right from the age of 4 up to the completion of their higher education.

Now let's see how much the company burnt in cash in the 2 years of Phase 1:

A majority of the cash burnt was spent on the marketing efforts in a mad race to acquire learners before the competitors during the peak Covid days of 2020 and 2021. According to the FY 20-21 financial reports the company spent as much as $300Mn in marketing expenses, that is 3X of the COMBINED marketing spend of the next 3 biggest Edtech in India, i.e. Unacademy, Vedantu and Upgrad.

Therefore by the end of Phase 1, the company was left with $1.55Bn cash and an annual burn rate of $950Mn. With less than 2 years of Cash Runway at the end of Phase 1, signs of stress were already appearing on the horizon. How did it pan out?

80% of the cash-in-hand was a debt that the company took in Nov'21 - which would run into its own share of problems through Phase 2 and 3.

Byju's could raise only $250Mn more in equity funding and $300Mn in debt through Phase 2 and Phase 3 (21 months), leaving them with a max cash runway of 5 months and an eroding valuation by the end of 2023.

It's now clear that during peak-euphoria, Byju's forgot to account for its working capital requirements, both for its core operations as well as for its acquiree companies.

Problem 2:

The founders continued to show an optimistic picture of the company's financial performance through Phase 1 when the audited financials read an opposite story

No matter how much money you're raising, VCs will tell you to spend all of it in the next 18-24 months chasing growth. They also assure that they will invest more after this cycle. But this usually comes with 1 caveat, i.e. you're able to show that massive growth in revenue y-o-y before you come asking for funds again.

All through Phase 1, the investors of Byju's were lead to believe that the company was growing leaps and bounds. Interestingly, the company recorded an impressive growth in its paid subscriber base by 57% to 5.5Mn subscribers through FY 20-21. Which is also the same % by which its valuation grew through FY 20-21 (From $8.25Bn to $13Bn). Probably that is what the investors were buying into.

However, problem started mounting when the company locked horns with its auditors, Deloitte on how to recognize revenue on long term contracts entered into during FY 20-21, with the latter insisting on restating revenue that would considerably bring down the numbers. Maybe there were genuine disagreements and hardly any time to resolve it such that the audited results that were supposed to be released by Sep'21 could only be released in Sep'22. Or maybe, it was a convenient deadlock by Byju's to allow them to keep raising funds before the market dried up and before it had to tell its investors that the numbers are not that appealing after all. Between Sep'21 and Sep'22, Byju's raised $2.8Bn in Equity and Debt.

And what did we find in the FY20-21 financial results?

Revenue almost flat lined. In fact, its core operations in India recorded a contraction in revenue by 40% when other Edtech Startups actually grew by up to 4 times during the FY (Covid induced boom).

In interviews, Byju Raveendran would tease that they were anticipating to get really close to $1Bn in revenue in FY20-21. When they landed at $300Mn only!

Outcome?

Byju's broke the trust of its investors. From Sep'22 till date, the company has been able to raise only $250Mn in equity.

In 2023, 3 of its board members representing different investors resigned from the board, as they alleged that their advise was often overlooked by the founders.

In 2023, a group of investors even demanded for Byju Raveendran to step down from his current role.

The existing investors continue to cut down the valuation of Byju's in their books, with the latest cut coming from BlackRock in Jan'24, slashing the valuation to $1Bn.

Problem 3:

Byju's was anticipating more capital in the near future, which never came

Byju's would have still found new investors to invest more money in them if it wasn't for Startup & Tech funding further crippling down in Phase 3 following global macro-economic headwinds. While the entire ecosystem's funding contracted by 60% y-o-y in 2023, the Edtech Sector was at the epicenter of the meltdown as funding contracted by 88%. Here's a chart to give you an idea:

2 out of every 5 layoffs done through Phase 2 and 3 by the Indian Startup ecosystem was by Edtech startups who were struggling to raise money.

So, on one side, the existing investors refused to draw another cheque and on the other side, the possibility of roping in a new investor was looking increasingly unlikely. Now carrying the fate of over 20 startups together and with an annual burn rate close to $1Bn, Byju's was left high and dry.

Problem 4:

Byju's thought Debt is cheap

In Nov'21, Byju’s — like Pharmeasy — made a bold bet at a time when overseas bank lending rates were low and took a $1.2 Bn TLB Loan (a type of loan where you need to pay only the interest component during the tenure of the loan, along with a fractional amount of the principal component, and a lumpsum amount at the end of the tenure). Here's what went wrong with the loan:

The interest rate back then was an unreal 5.7% (5.5% + LIBOR @0.2% in Nov'21).

Through Phase 2 and Phase 3, LIBOR soared to 5.5%, which means that in a span of just 2 years, the company's interest cost doubled to 11%.

What's worse is that at the beginning of Phase 3, lenders demanded to re-negotiate certain terms of the loan agreement, possibly triggered because of the delay in releasing FY 21-22 financials by Byju's and because of their poor financial results in FY 20-21. And how did Byju's respond? It locked its horns with the lenders by completely stopping interest payments and pulling them to court claiming that the revised terms were predatory.

Per report by ET in Aug'23, Byju's may end up paying as much as $50-60Mn additionally p.a. in interest due to re-negotiations going on with the Lenders. This will take the annual interest obligation to $130-190Mn, which significantly adds to the cash burn.

Long story short, Byju's has still not resumed interest repayments on the loan. In the latest update, the overseas lenders have filed a bankruptcy petition in India against the company.

Long story short, Byju's has still not resumed interest repayments on the loan. On 25th of Jan'24 the overseas lenders filed a bankruptcy petition in India against the company.

Word on the street is that Byju's is now looking to sell some of its biggest acquisitions, Epic and Great Learning for $800-$900Mn (Bought at $1.1Bn in May’22/July'21 respectively) to get rid of the entire TLB loan at once.

Problem 5:

Unhappy customers and leaders' exodus

A survey by NDTV revealed that 35% of users were not satisfied by Byju's, and 20% of unsatisfied users did not get a refund when they asked for it as mentioned in their refund policies.

A research by MoneyControl in Aug'23 claimed that nearly 2 out of every 3 Byju’s Tuition Centre's customers have requested refunds in the past 2 years, indicating there is significant dissatisfaction among parents and students with the pedagogy (Although this was strongly refuted by Byju’s).

A study by The Ken stated that 54% of customers were unaware that they were opting for a loan when they were paying for their Byju's subscription in parts.

More than 10 senior executives have left the company in Phase 3. Here's the list:

While the FY 22-23 financial results are yet to be published, here's what we can make out about the company's state of affairs:

The reports on dissatisfied customers and Byju's sales team resorting to mis-selling, indicate the high churn rate of Byju's paid subscribers.

In FY 19-20 the company had a negative net margin from its core operations of only 11%. This climbed to more than 100% both in FY 20-21 and FY 21-22, indicating that the company is facing a tough climb to grow its operations.

It is customary for companies to share regular MIS reports to investors that update them on the key operating numbers of the business. The fact that several investors have marked down the valuation of Byju's on repeated intervals over the last 1 year (For eg. Prosus that holds around 10% stake in the company first marked down the valuation to $5.1Bn in Mar'23 and then to $3Bn in Nov'23), is another strong indicator that there is a growing concern around the company's operational performance and future growth prospects.

The mass exodus of the company's senior management indicates that possibly the company has reached a point from where it is difficult to recover.

To sum it up

Byju's which was once the crowned jewel of India's Startup ecosystem, now stands engulfed with challenges with a looming debt trap, fleeing senior management, unhappy customers, poor investor sentiments, unfavorable fundraising environment and gross operational underperformance. With a near-perfect entrepreneur handbook in making, probably there is only 1 more lesson that Byju Raveendran is left to deliver- i.e. how to turnaround a failing business.

As Raveendran likes to put it, if you were looking at all of this from a 30-40 years long view, there will be cycles like this for 2-3 times, but it will still work out in the end. Like everyone else who have grown so fast, Byju's has also made their fair share of mistakes in the process. But there is a strong intent to rectify each of these mistakes.

The big question

Is this phase just a blip on Byju's success story? Or is it too late to turn things around? Let us know what you think in the comments section below.

This article is a part of the January'24 edition of our Startup Newsletter. Here's the complete publication:

Comments